sales tax calculator bakersfield ca

The results are rounded to two decimals. CA Sales Tax Rate.

California Sales Tax Rates By City County 2022

The average sales tax rate in California is 8551.

. The current total local sales tax rate in Bakersfield CA is 8250. The minimum combined 2020 sales tax rate for Bakersfield California is 825. The latest sales tax rate for Del Kern Bakersfield CA.

Fill in price either with or without sales tax. There is base sales tax by California. 3 beds 2 baths 1343 sq.

California Department of Tax and Fee Administration Cities Counties and Tax Rates. Taxes-Consultants Representatives Tax Return Preparation Tax Return Preparation-Business. Find list price and tax percentage.

The current total local sales tax rate in Bakersfield CA is 8250. Then use this number in the multiplication process. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

The California sales tax rate is. The 825 sales tax rate in Bakersfield consists of 6 California state sales tax 025 Kern County sales tax 1 Bakersfield tax and 1 Special tax. Method to calculate Del Kern Bakersfield sales tax in 2021.

The 825 sales tax rate in bakersfield consists of 6 california state sales tax 025 kern county sales tax 1 bakersfield tax and 1 special tax. This includes the rates on the state county city and special levels. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

YEARS IN BUSINESS 661 432-7676. 11200 Baron Ave Bakersfield CA 93312 435000 MLS 202205514 Large detached shop with super long RV parking on a corner lot that includes pool in. Name A - Z Sponsored Links.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Real property tax on median home. 4 beds 3 baths 1770 sq.

As far as sales tax goes the zip code with the highest sales tax is 93301 and the zip code with the lowest sales. Del Kern Bakersfield 8250. This is the total of state county and city sales tax rates.

The Bakersfield sales tax rate is. The County sales tax rate is. Sales Tax Calculator in Bakersfield CA.

California has a 6 statewide sales tax rate but also has 474 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2617 on top of the state tax. The minimum combined 2022 sales tax rate for Bakersfield California is. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. Del Mar Heights Morro Bay 7750. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to California local counties cities and special taxation districts.

Download all California sales tax. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Bakersfield CA.

For tax rates in other cities see California sales taxes by. The average cumulative sales tax rate in Bakersfield California is 792. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. We found 395 results for sales tax calculator in or near bakersfield ca. 5 digit Zip Code is required.

You can print a 825 sales tax table here. Within Bakersfield there are around 21 zip codes with the most populous zip code being 93307. Counties cities and districts impose their own local taxes.

The businesses listed also serve surrounding cities and neighborhoods including bakersfield ca delano ca and wasco ca. CA Sales Tax Rate. Bakersfield is located within Kern County California.

How to Calculate Sales Tax. For State Use and Local Taxes use State and Local Sales Tax Calculator. California City County Sales Use Tax Rates effective April 1 2022.

Sales Tax State Local Sales Tax on Food. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Please ensure the address information you input is the address you intended.

Choose the Sales Tax Rate from the drop-down list. Type an address above and click Search to find the sales and use tax rate for that location. 3413 Margalo Ct Bakersfield CA 93313 390000 MLS OC22130885 Such a great opportunity to.

Enter your Amount in the respected text field. US Sales Tax California Kern Sales Tax calculator Bakersfield incorporated. 125 lower than the maximum sales tax in CA.

Multiply the price of your item or service by the tax rate. Most transactions of goods or services between businesses are not subject to sales tax. The sales and use tax rate in a specific California location has three parts.

Bakersfield California Sales Tax Rate 2020 The 825 sales tax rate in Bakersfield consists of 600 California state sales tax 025 Kern County sales tax 100 Bakersfield tax and 100 Special tax. The tax rate given here will reflect the current rate of tax for the address that you enter. The December 2020 total local sales tax rate was also 8250.

Check your city tax rate from here Thats it you can now get the tax amount as well as the final amount which includes the tax too Method to calculate Bakersfield sales tax in 2021. The California sales tax rate is currently. This is the total of state county and city sales tax rates.

How to use Bakersfield Sales Tax Calculator. Our sales tax calculator will calculate the amount of tax due on a transaction. Choose the Sales Tax Rate from the drop-down list.

California Vehicle Sales Tax Fees Calculator

California Vehicle Sales Tax Fees Calculator

California Vehicle Sales Tax Fees Calculator

6 Sales Tax Calculator Template Tax Printables Sales Tax Tax

California Vehicle Sales Tax Fees Calculator

Locating And Discovering Sales Tax Medical Icon Sales Tax Medical

How To Use A California Car Sales Tax Calculator

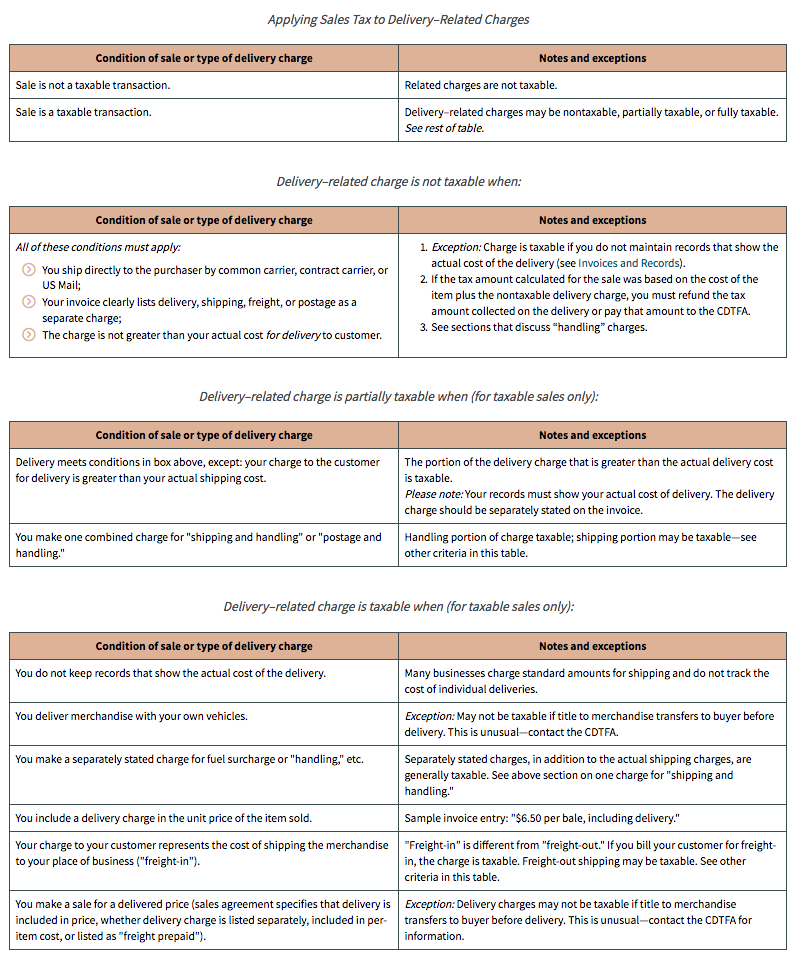

Is Shipping In California Taxable Taxjar

Food And Sales Tax 2020 In California Heather

California Used Car Sales Tax Fees 2020 Everquote

Are California Businesses Subject To Sales Tax On Sales To Residents Of Foreign Countries

Capital Gains Tax Calculator 2022 Casaplorer

California Sales Use Tax Guide Avalara

California Sales Tax Calculator Reverse Sales Dremployee

California Sales Tax Calculator Reverse Sales Dremployee

Is Shipping In California Taxable Taxjar